The “Next Normal” and Digital Banking

Coined by McKinsey, “The Next Normal” is the assumption that our era will be defined by the period before COVID-19 and the “next normal” that will emerge in the post-viral era. The COVID-19 pandemic forced banks and their customers to adapt quickly to limitations on physical interactions. As a result, digital adoption by bank customers has accelerated.According to McKinsey in Italy, Spain, and the US, 15 to 20 percent of customers surveyed expect to increase their use of digital channels once the crisis has passed.

As emerging digital preferences become banking’s post COVID-19 “next normal,” McKinsey further reports that retail banking may experience up to three years of digital preference acceleration in 2020.

Banks are Using Horizn to Support Digital Adoption

Horizn’s bank customers globally are using our Customer Direct platform as part of their market re-entry to make certain their customers are confident and able to bank digitally. Nearly every institution on the planet has two enduring challenges and the platform is specifically designed to help institutions achieve both of these objectives,

- Getting the digital laggards to bank with you digitally

- Getting the active digital users to more broadly leverage the bank’s digital assets

What is the Customer Direct Platform and what are Digital Demos?

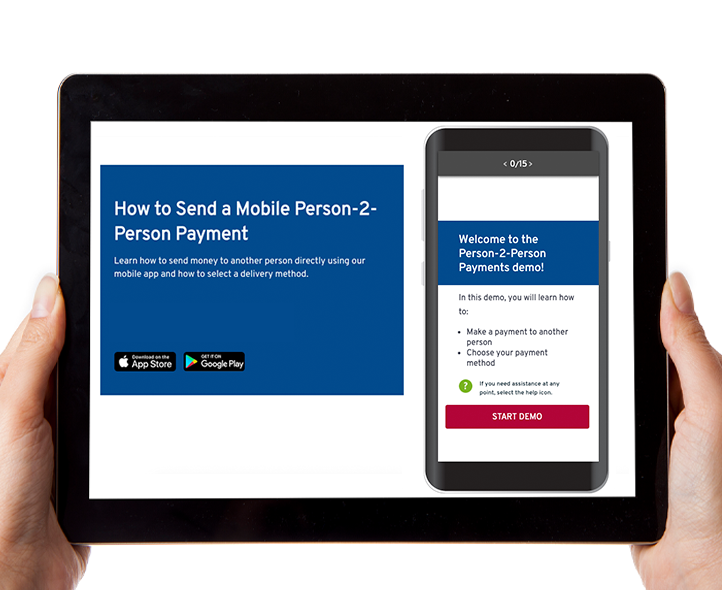

The Customer Direct Platform is a central hub that hosts all your product Digital Demos used to help customers with online and mobile banking. Horizn makes certain your customers have the confidence and know-how to bank digitally right away. Our Digital Demos allow customers to practice mobile and online banking, allowing them to quickly become digitally fluent and confident. The Platform is used globally to educate customers on all things digital, across all lines of business: mobile and digital banking, retail banking, business banking and wealth management.

Using Horizn to Support Customer Digital Banking in Contact Centers

The Customer Direct platform is used to help customers who are looking for digital banking support. Contact center staff use the Digital Demos to quickly answer customer questions and provide digital banking guidance. Banks using the platform see a reduction in call handling times and an increase in first-time call resolution.

Using Digital Demos to Communicate Directly with Your Customers

Using Horizn, banks can directly communicate and distribute digital product knowledge directly to customers across all channels: Bank websites, support pages, FAQs and via digital marketing, email campaigns, chatbots, and mobile app integration.