Rapidly increase digital banking knowledge and training for every employee.

As banks and credit unions overhaul their organizational structure to achieve the ideal of a digital agile organization, they must also commit to introducing new skills and capabilities to their employees. Financial institutions must take aggressive steps today to ensure the frontline are ready for digital transformation.

Digital Advocacy: We make sure all your employees are easily able to learn and understand the product and service you are offering. How can you support a customer if your employees have not used or do not know anything about it your latest innovation.

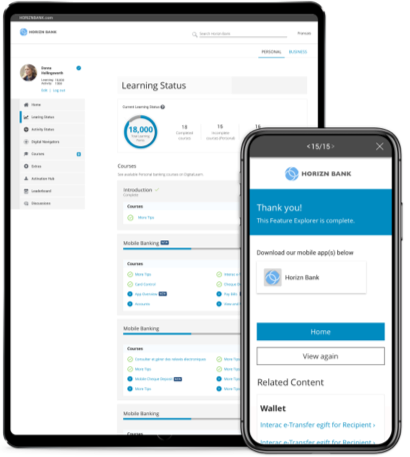

Comprehensive Set of Tools: The Employee Platform is a comprehensive set of tools designed to help employees become digitally aware, digitally fluent, and confident enough to have digital conversations with customers and increase customer digital banking usage.

Rapid Increase Knowledge: With Horizn, financial institutions rapidly deliver the latest digital product knowledge to frontline employees in an engaging, agile, and persistent manner.

Celent Model Bank Award: Investment in digital activation resulted in demonstrable improvements in employee and client engagement

RBC Wins Celent Model Bank of the Year 2020 Download the Case Study >

It’s not just knowing that we have digital capabilities, but it’s also being confident about talking about those digital capabilities, and the importance and the value of digital to our clients.